Established financial service providers are facing a whole new breed of competitors. They are strong consumer brands branching into financial services, and aggregators offering products with the transparency that customers look for. These competitors have at least one thing in common: their services are way better than what the established players offer.

The way people choose and consume financial services has changed. With the help of technology, products are more customer-focused and innovative. It is the customer experience, not only price, that determines a provider’s success.

The way people choose and consume financial services has changed. With the help of technology, products are more customer-focused and innovative. It is the customer experience, not only price, that determines a provider’s success.

While authorities and regulators demand more transparency in financial products, ultimately it is the customers who force financial organisations to make their products and services clearer and simpler. In most markets, customers can now compare services from different providers, which often also offer incentives and assistance to lure customers to switch. Overly complex products, therefore, are likely to lose customers.

One of the main reasons for people to switch service providers is service failures. Depending on the complexity of the product and its impact on people’s lives, customers always need quite specific information and assistance. Basic services such as providing essential information in a timely and easy-to-understand manner can also prevent unnecessary customer irritation.

Fill the gap in customer context

Financial products and services are essential to customers’ lives, and affect the choices they make in the present and future. Measuring customer satisfaction and running Voice of the Customer (VoC) programmes are very helpful in capturing how customers interact with an organisation. Understanding the customer lifecycle helps fill some of the missing context, such as what customers are really experiencing, and why successful products cause irritation.

96% of unhappy customers don’t complain, however 91% of those will simply leave and never come back.

Do not surprise with gimmicks

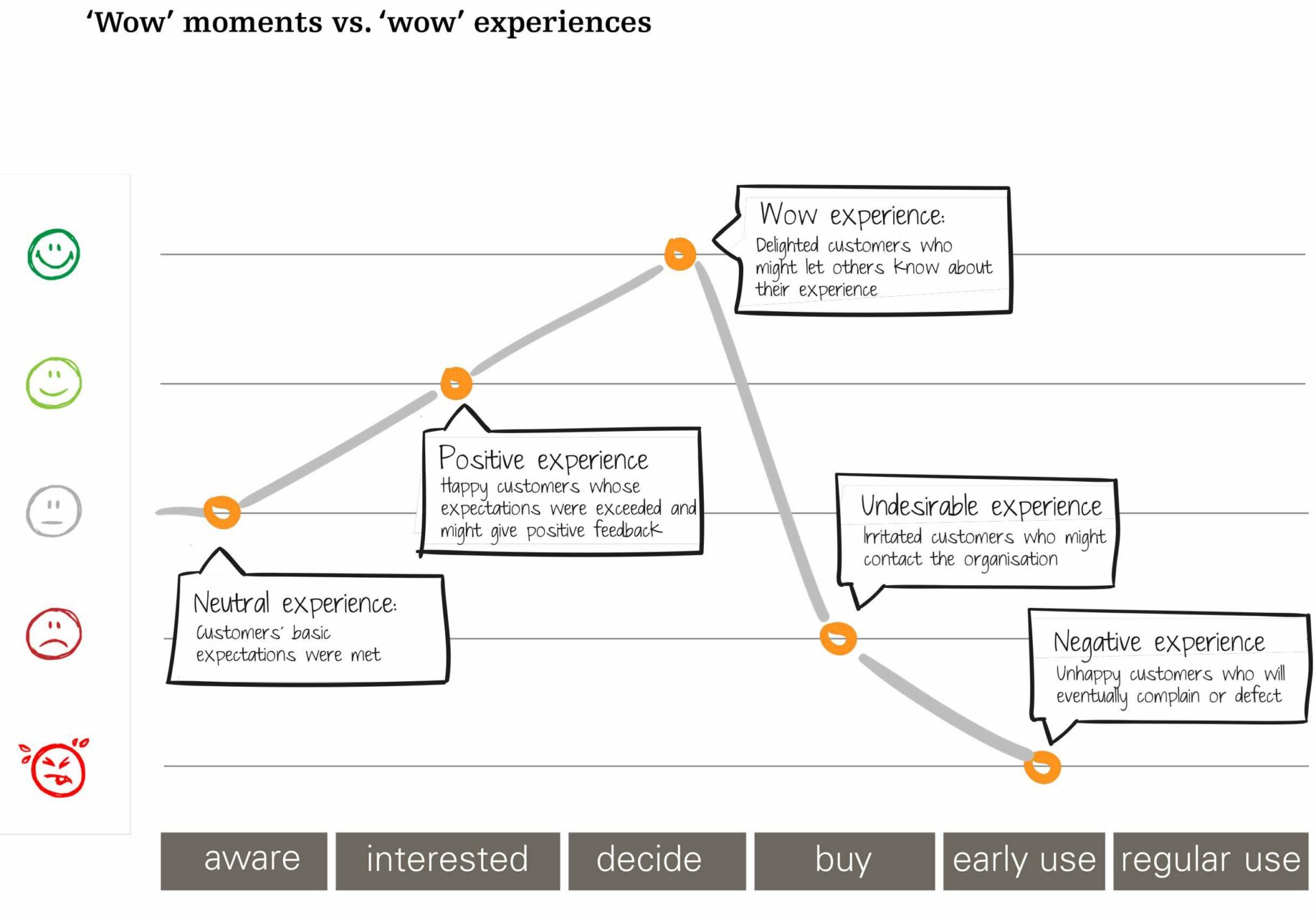

Creating ‘wow’ moments, oftentimes with incentive-based schemes, might actually be bad for the overall customer experience, because it sets expectations too high to be met again. Therefore, making basic transactional services easy to use, or offering expert guidance for complex products are better ideas to improve services.

It may sound simple to consistently meet basic customer expectations irrespective of channels, but it requires internal alignment and external focus. Addressing obvious and basic service failures is a good place to start, and often yields surprising results.